Hi-Stat Vox No. 23 (June 18, 2012)

Natural Disasters and Firm Dynamics: Lessons from the Kobe Earthquake

Iichiro Uesugi

Associate Professor, Institute of Economic Research, Hitotsubashi University

Introduction

It is now more than a year since the Tohoku region in the northeast of Japan was struck by a powerful earthquake, which was accompanied by a devastating tsunami and triggered a major nuclear accident. Although considerable progress has been made since then, reconstruction and recovery from the disaster still have a long way to go. Key to a sustained recovery will be the revival of industries in the disaster areas. An important question therefore is how to instill renewed vigor in corporate activity, and any answers to this question require a good understanding of the effects that the earthquake has had on corporate activity.

In this context, the experience from the Kobe earthquake, which struck the city of Kobe and surrounding Hyogo prefecture in January 1995 potentially holds important lessons. Examining the impact of the Kobe earthquake on corporate activity potentially provides valuable clues regarding economic revival in the areas affected by the Tohoku earthquake.

Numerous studies on the Kobe earthquake already exist. However, these tend to focus on the immediate damage to industry caused by the earthquake, and there are very few studies that provide a detailed analysis of medium-term changes in corporate behavior using firm-level data. Yet, examining the impact of the Kobe earthquake using micro-level firm data can offer important insights. In this column, which is based on on-going research we are conducting, I would like to focus on the following three points in particular: (1) the impact of the Kobe earthquake on firm survival (i.e., whether firms went bankrupt and exited); (2) the impact of the earthquake on firm relocation; and (3) firms’ capital investment behavior following the earthquake.

The data for the analysis are taken from the large-scale database of Teikoku Databank, which contains observations on more than 1 million firms. Using this database, Hitotsubashi University and Teikoku Databank, in a joint project, have constructed a dataset that can be used for analyses such as the present one. For 1994, the dataset contains information on around 94,000 firms located in Hyogo and Osaka prefectures (of which approximately 19,000 firms are located in the area affected by the 1995 Kobe earthquake). Of these, additional financial data are available for 12,000 firms (2,000 in the Kobe earthquake area), and these 12,000 firms form the backbone for the analysis of firm survival and capital investment. However, detailed financial data are not necessary for the examination of whether firms relocated, so the sample for this part of the analysis consists of all 94,000 firms.

It should be noted, however, that the exact number of sample firms used in each part of the analysis differs somewhat from these figures depending on the data availability for certain variables. Particularly for the estimation of fixed investment functions, data for variables such as fixed assets for both the preceding and the current year are necessary, so that in this case the sample size shrinks to about 8,500 firms.

High bankruptcy rate for disaster area firms that transacted with financial institutions located in the disaster area themselves

Generally speaking, it seems quite natural to assume that bankruptcies increase following a large earthquake. Possible reasons for such an increase are that firms face difficulties in carrying on their business as a result of damage to fixed assets such as plants, shops, and machinery and equipment, and to their inventories, or that the business operations of transaction partners are interrupted, so that selling and/or procuring products becomes difficult. Based on this line of reasoning, the first step of the analysis examines whether bankruptcies really did increase as a result of the Kobe earthquake. Looking simply at the bankruptcy rate, however, shows that this was always lower in the disaster area than in other areas of the two prefectures, including in the wake of the earthquake. Specifically, the bankruptcy rate in the disaster area was consistently about 0.3 to 0.9 percentage points lower than in other areas.

However, any impact of the earthquake on bankruptcy rates may possibly be easier to discern if we examine not the level but the change in the bankruptcy rate. Therefore, setting the bankruptcy rate in 1991, i.e., before the earthquake, as the benchmark, we compared subsequent changes in the bankruptcy rate in the disaster area and in the rest of the two prefectures. Doing so, we found that still in many cases the increase in the bankruptcy rate in the disaster area was smaller than in the other areas.

Further careful analysis of the data leads to the following three observations. First, the probability of bankruptcy was not significantly affected by the extent of the damage that a particular firm suffered. That is, bankruptcies did not increase, because many firms were able to take advantage of support measures provided to firms in disaster areas, such as credit guarantee programs, so that large-scale damage did not necessarily lead to bankruptcy.

Second, regardless of whether they were located within or outside the disaster area, firms that transacted with a financial institution that was affected by the earthquake had a higher probability of going bankrupt than other firms. Firms in the disaster area which had transacted with quake-stricken financial institutions were more likely to default than other firms in the same area not because the former were inherently low-quality, but because the financial institutions they transacted with were affected by the earthquake. Thus, it appears that an important reason why the bankruptcy probability of firms located in the disaster area increased is that there was a disruption in the smooth provisioning of funds.

Third, when we compare the absolute value of the marginal effect of the own capital ratio, the ratio of operating profits to total assets, and the cash ratio for firms in the disaster area and firms in the rest of the two prefectures, we find that the coefficients for the former are not greater than those for the latter. Thus, although it is possible that, as a result of greater uncertainty due to the earthquake, firms’ financial soundness played an increased role in their survival probability, the results suggest that this was not necessarily the case.

Firm relocations increased, but many firms moved only a short distance

When a major earthquake occurs, there will inevitably be some firms that relocate. One of the issues we therefore examined is to what extent the number of firms that relocated increased as a result of the Kobe earthquake and, moreover, what the reasons for relocating were. Further, we examined how the existence of industry agglomerations prior to the earthquake affected relocation, and how industry agglomeration and firm performance changed after the earthquake.

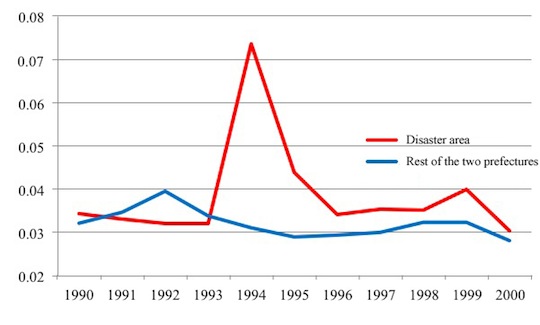

Starting by comparing the relocation rates in the disaster area and the rest of the two prefectures, we find that the relocation rate of firms in the disaster area increased substantially following the earthquake and greatly exceeded the relocation rate of firms in the rest of the two prefectures during the same period (see Figures 1 and 2). Specifically, while the relocation rate between 1994 and 1995 in the disaster area was 7.4%, that in the rest of the two prefectures was only 3.1%.

Figure 1. Relocation rate

Notes:

1. The relocation rate is calculated as the number of firms that relocated between years t and t+1 divided by the number of firms in year t.

2. Relocations are defined as cases in which the location of the head office changed by 0.1km or more.

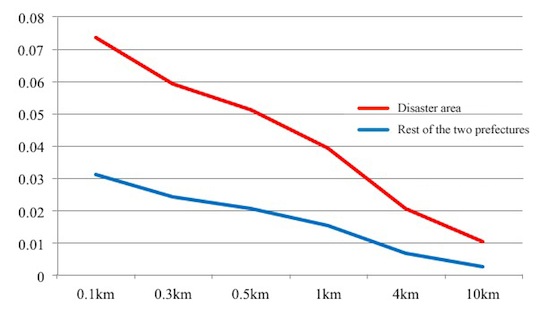

Figure 2. (1994-1995; by distance of relocation)

Note: A relocation is defined as a case in which the location of the head office changed by x km or more.

However, it is important to note that many firms actually moved only a relatively short distance. The relocation rate falls rapidly if we increase the minimum distance used to define relocation. In practice, relocations of only a short distance cannot really be called relocations and cannot be regarded as a move away from a particular industry agglomeration. For this reason, especially when considering the effect of relocation on industry agglomeration, it is important to keep this point in mind.

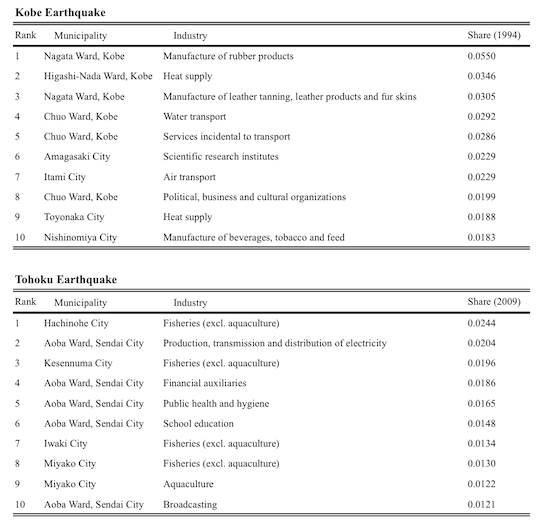

Next, let us examine what sort of changes can be observed in industry agglomeration as a result of firm relocation following the Kobe earthquake. In this context, it should be noted that the area affected by the Kobe earthquake contained places with a high population density, such as Kobe City, and numerous industry agglomerations. To illustrate this, Table 1, based on the 1994 Establishment and Enterprise Census, presents the top 10 agglomerations within the area based on the share each municipality accounted for in terms of the total national employment in a particular industry. The table shows that Nagata Ward in Kobe City, for example, accounted for a substantial share of national employment in manufacturing industries such as rubber products (5.5%) and leather tanning (3.1%). Similar agglomerations can be found in Chuo Ward (also in Kobe City) in the water transportation industry and services incidental to transportation, and in Nishinomiya City in beverage manufacturing.

Table 1: Municipalities in the Kobe and Tohoku earthquake areas with high industry agglomerations (top 10 regions/industries)

Note: Share of the number of employees in industry j in municipality r in the national total number of employees in industry j.

Source: Establishment and Enterprise Census, Statistics Bureau (various years).

Looking at how municipalities that had high industry concentrations fared in terms of their industry shares, we find that the higher that share was in 1994, the more it had decreased in 1996. The tendency thus appears to be that the higher the degree of agglomeration in a particular municipality and industry in the region affected by the earthquake was, the more that agglomeration was lost as a result.

We also examined whether there were any differences, and if so, what kind of differences, in the ex-post performance of firms that relocated and firms that did not relocate after the earthquake; however, our results indicate that whether a firm had relocated or not did not significantly affect its performance.

Capital investment by disaster area firms increased through the first year after the earthquake

Assuming that prior to the earthquake firms’ capital stock was at the optimal level and that there was no change in the business environment following the earthquake, we would expect firms to increase their capital stock faster the greater the damage to their fixed assets through the earthquake. However, in practice, many firms are likely to experience capital constraints in the wake of an earthquake and firms will therefore differ in the extent to which they can increase capital investment to restore fixed assets damaged by the quake.

To examine this issue, we compared the capital investment trends before and after the earthquake of firms located in the disaster area and firms in the rest of the two prefectures. In addition, we examined how various balance sheet items responded to changes in fixed assets. In both cases, we focus on the period from 1993 to 1999. The analysis indicates that until 1995, when the earthquake occurred, capital investment of both firms in the disaster area and those in the rest of two prefectures continued to decrease and the average in 1995 was in fact negative. On the other hand, for 1996, a clear contrast can be observed: whereas the capital investment of firms in the disaster area turned positive, that of firms in the rest of the two prefectures remained negative.

This suggests that firms that sustained damage to fixed assets invested more actively than firms in other areas not immediately after the earthquake, but in 1996, one year after the earthquake. Looking at the fund procurement pattern of disaster area firms, we find that the increase in fixed assets is mirrored by a small decrease in cash holdings as well as increases in loans and capital. Moreover, whereas loans taken out by disaster area firms increased, those by firms in the rest of the country decreased.

Further, we examined the effect of capital constraints arising from the fact that financial institutions that firms transacted with themselves were affected by the earthquake. We found that while such capital constraints did not affect all sample firms, they did reduce the increase in capital investment of those firms whose collateral had been impaired as a result of damage to fixed assets.

How are these findings relevant to the recovery from the Tohoku earthquake?

Clearly, the Tohoku and Kobe earthquakes differ in major respects and the findings of our analysis cannot be applied directly to aid recovery from the Tohoku earthquake. The former caused damage in a huge area, which, however, is relatively sparsely populated, while the latter directly affected a densely populated area. Moreover, the Tohoku earthquake differs greatly from the Kobe earthquake in that it was accompanied by a major tsunami and a nuclear accident. Finally, the economic performance of firms in the two areas before the respective earthquakes also differs.

That being said, the results of the analysis of the Kobe earthquake nevertheless hold quite a few useful lessons for the reconstruction and recovery efforts in Tohoku. For example, an important finding is that the bankruptcy probability of firms that have transaction relationships with financial institutions located in the affected areas increased. The Kobe area is host to a large number of financial institutions that are potential providers of funds, such as city banks, and it is likely that funding constraints following the earthquake were probably weaker than they would have been in other regions. Yet, even here, there were financial constraints originating mainly from the side of lenders. In contrast, in the area affected by the Tohoku earthquake, there are relatively few potential suppliers of funds and it is likely that borrower firms face even stronger financing constraints than firms in the case of the Kobe earthquake. Given this background, it seems especially important to ensure, through policy measures such as capital injections, that financial institutions in the affected areas remain sound in order to ensure that they can smoothly provide funds to firms they transact with.

At the same time, it also needs to be borne in mind that the average business performance of firms in the area affected by the Tohoku earthquake is below the national average. This is a major difference from firms in the area affected by the Kobe earthquake, whose performance was in line with the national average. While it is extremely important to ensure that highly profitable firms recover, it is also essential to pay attention to the fact that blindly providing new loans without carefully scrutinizing whether they can actually be repaid only exacerbates the problem by providing funds to borrowers that should not receive any.

Turning to the issue of business relocation, we found that, following the Kobe earthquake, the relocation rate increased, but many firms only moved a short distance. In contrast, in the case of the Tohoku earthquake, there will likely be many cases in which moving the business a considerable distance is unavoidable because of the need to leave an area that might again be affected by a tsunami in the future and/or because of the establishment of the exclusion zone due to the nuclear accident at Fukushima. In cases where externalities created by agglomeration may be lost as a result, it is necessary to consider effective policy measures in order to maintain such externalities. For instance, maybe mechanisms should be devised to enable firms that move a long distance to maintain relationships with existing transaction partners while developing new transaction relationships.

Concluding remarks

Having examined the impact of the Kobe earthquake on firm behavior, our next task is to focus on changes in firm behavior brought about by the Tohoku earthquake and to look at how these affect the efficiency of the Japanese economy overall. We will focus in particular on firm relocation: it is likely that a large number of firms will move away from existing agglomerations to other locations as a result of the earthquake, and what we would like to examine is how this affects firms’ performance, whether firms maintain the relationships with existing transaction partners, etc. At the time of the Kobe earthquake, detailed firm-level data, including information on transaction partners, did not exist; now, however, such data are available from Teikoku Databank, making such analyses possible. Examining in detail changes in the behavior of firms that relocated should provide insights of considerable use for the economic recovery and revival of the area affected by the Tohoku earthquake.

References

Uesugi, Iichiro, Hirofumi Uchida, Taisuke Uchino, Arito Ono, Makoto Hazama, Kaoru Hosono, and Daisuke Miyakawa (2012) “Natural Disasters and Firm Dynamics,” RIETI Policy Discussion Paper Series No.12-P-001.

Teikoku Databank (2011) “Survey on Bankruptcies after the Kobe Earthquake,” TDB Watching, April 8 (in Japanese).